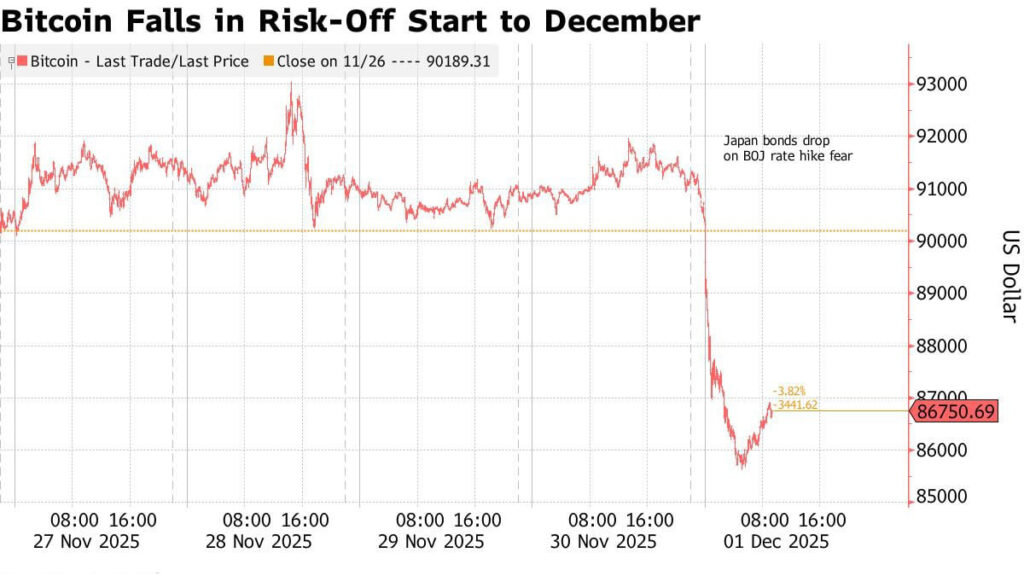

⚫️ S&P 500 futures fell 0.7%, while Bitcoin slipped below $86,000, dragging crypto-linked stocks and major tech names lower

⚫️ Japan’s 2-year yield climbed to its highest level since 2008 after BOJ Governor Ueda hinted at a possible rate hike

⚫️ The yen strengthened, lifting global bond yields — the US 10-year rose to 4.04%

⚫️ Traders now assign an ~80% chance of a BOJ hike in December, raising concerns over a shift in global liquidity

⚫️ Oil gained after damage to a key Kazakh export terminal halted loadings, while silver and copper rebounded

The pullback comes after the S&P 500 posted its seventh straight monthly gain. Markets now turn to upcoming US macro data — manufacturing, employment, and inflation — ahead of the Fed’s final meeting of the year.

“https://www.investing.com/analysis/global-market–crypto-shock-from-selloff-to-signs-of-recovery-200671170Bitcoin’s drop is weighing on sentiment, and BOJ comments added pressure,” said Saxo’s Andrea Tueni. Analysts warn December may prove tougher than expected, with markets already pricing nearly a 90% chance of a Fed rate cut.